Best-selling book from three of the best estate planning advisors in the country!

Free Book:

"ORCHESTRATE YOUR LEGACY"

Advanced tax and legacy planning.

What Is This Book About?

We have written it for the benefit of higher-earning, self-employed people who are looking for concrete ways to save for the future, protect their families, pay less in taxes, and pass on more for generations to come.

This book is a comprehensive resource to understand the key financial strategies and how the components work together to secure your future wealth and lifestyle

HURRY! This Offer Won't Last Long!

This book normally sells on Amazon for $21.99. You can get it today for FREE!

Here's What You'll Learn Reading Orchestrate Your Legacy:

How to...

- Reduce your income and estate taxes

- Safeguard and control your assets now and into the future

- Protect your family, business and heirs for generations to come

-

Increase your wealth at a faster pace.

- Pass on your values and vision to your surviving family

We can help to spare you those sad losses. In the case studies throughout this book, you will find clear examples of how we have done that for others. If their problems strike a chord with you, that is probably because in one way or another you are much like them. You have a unique set of problems, and they call for a unique set of solutions. This book is for you. In it you will learn about the most common problems of successful high achievers and the most appropriate tools that can help them.

Table Of Contents

In these pages, you will find portraits of families and individuals who are facing specific challenges and who have found solutions that have helped them to move forward.

Introduction

What Do You Have to Lose?

Chapter 1

Chapter 2

Chapter 3

Chapter 4

Chapter 5

Chapter 6

Conclusion

HURRY! This Offer Won't Last Long!

This book normally sells on Amazon for $21.99. You can get it today for FREE!

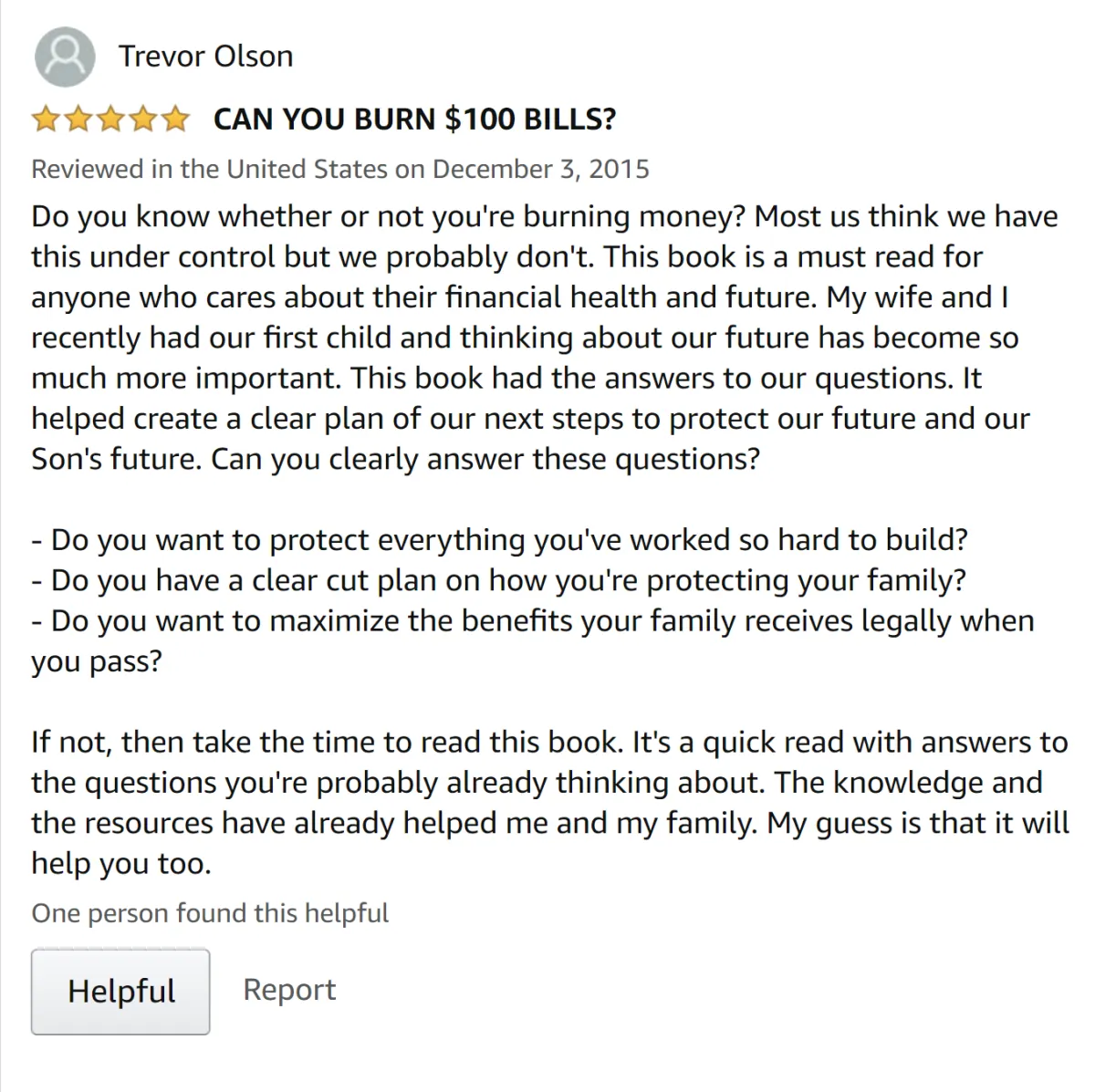

What People Are Saying About "Orchestrate Your Legacy" On..

HURRY! This Offer Won't Last Long!

This book normally sells on Amazon for $21.99. You can get it today for FREE!

Meet the authors...

Rick Bailey

J.D., MAcc, CFP®

Bob Crosetto